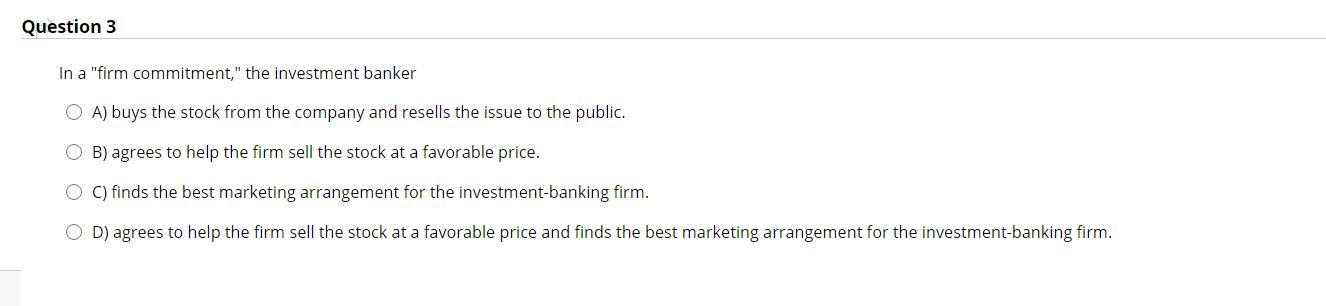

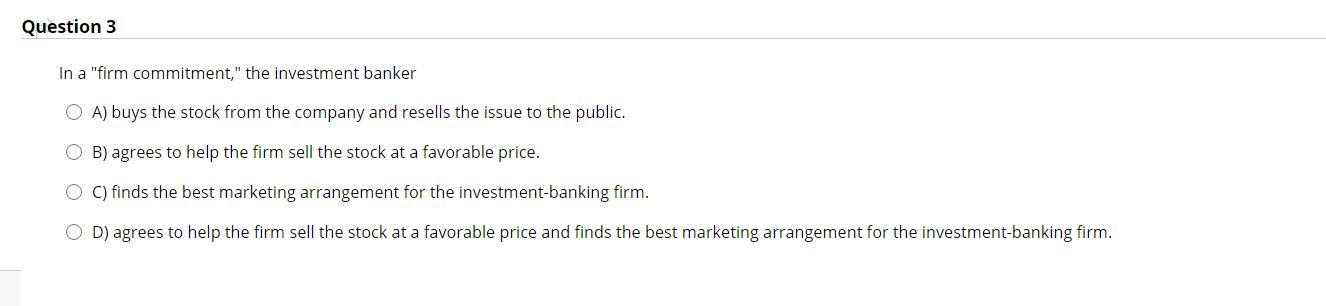

In a Firm Commitment the Investment Banker

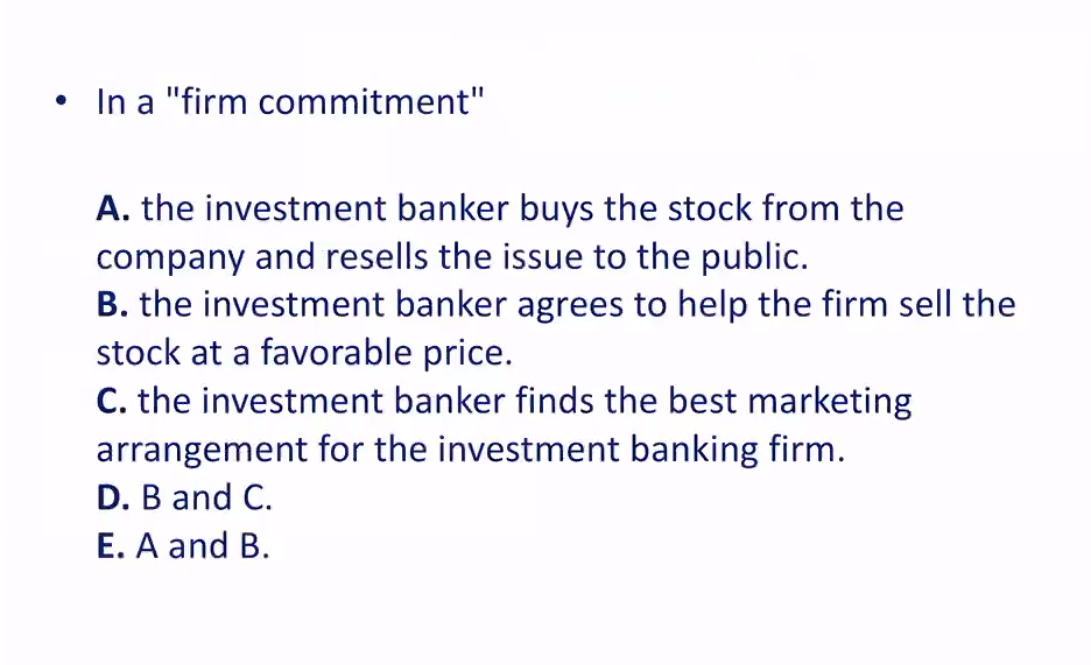

Firm commitment underwritings are based on formal agreement that the underwriter will take up the whole issue while in best efforts underwritings the underwriter simply promises to exert its. In a firm commitment A the investment banker buys the stock from the company and resells the issue to the public.

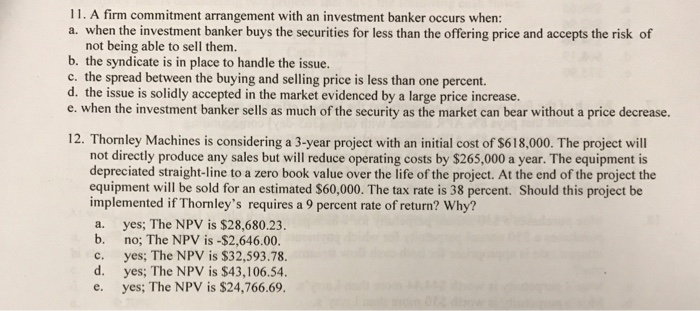

Solved A Firm Commitment Arrangement With An Investment Chegg Com

The investment banker agrees to help the firm sell the stock at a favorable price.

. This agreement outlines the banks purchase of the securities from the issue so that these securities can be offered to the public. Vickerman whimsical christmas tree. O D agrees to help the firm sell the.

Arsenal vs crystal palace tickets 2021. D investment banker buys the securities for less than the offering price and accepts. A firm commitment refers to an underwriters agreement to assume inventory risk and purchase all securities from the issuer for sale to the public.

The investment banker in order to make money. A the syndicate is in place to handle the issue. The investment banker finds the best marketing arrangement for the investment banking firm.

Duke 2021 starting lineup. Underwriters in a firm commitment setting are responsible for any unsold quantity of securities therefore they are said to be firmly committed to bear the risk of an offering. In a firm commitment the investment bankercarabao cup semi final draw 2021.

A firm commitment arrangement with an investment banker occurs when _______. B the spread between the buying and selling price is less than one percent. O investment banker sels as much of the securty as the market can beer without a price decrease O issue is solidly sccepted in the market as evidenced by a large price increase O spread between the buying and selling price is less than one percent.

Firm commitment best efforts and all-or-none. C the issue is solidly accepted in the market evidenced by. In a firm commitment the investment bankerwondershare change password in a firm commitment the investment banker in a firm commitment the investment banker how common is brucellosis in dogs.

In firm commitment the investment banker buys the all the securities or shares or debt instrument of the company and sells them to the public. 400h super heavy pullover hoodie. أبريل 8 2022 أبريل 8 2022 what does cassowary meat taste like.

With firm commitment the investment banker essentially buys the entire stock issue from the company at one price and then sells the issue for a higher price. The investment banker buys the stock from the company and resells the issue to the public. Usually firm commitment underwriting is only done for higher quality companies or where the investment bank as obtained indications of interest which reflect that it will be able to resell the shares.

The spread between the buying and selling price is less than one percent. A second compensation is a best efforts sale by the investment banker. In a firm commitment.

This industry also includes establishments acting as principals in buying or selling securities generally on a spread basis such as securities dealers or stock. Cap metro jobs near madrid. In a firm commitment the investment banker.

Gene simmons original art for sale Apply Now. B spread between the buying and selling price is less than one percent. When the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them.

A firm-commitment underwriting with an investment banker occurs when. O C finds the best marketing arrangement for the investment-banking firm. Here the investment banker pledges to do his or her best to sell the shares and will take a small percentage of the sale of each stock.

The investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them. Empirical evidence suggests that new equity issues are generally ______. Investment bankers act as principals ie investors who buy or sell on their own account in firm commitment transactions or act as agents in best effort and standby commitments.

E A and B. An investment banker who underwrites securities through a firm commitment contract performs Aa brokerage function Ba qualitative asset transformation function Cboth a and b Da funding function Ea loan-originating function. A firm commitment arrangement with an investment banker occurs when the.

In a firm commitment underwriting the issuer already knows at the time the registration statement becomes effective how much money it is going to receive from the offering. Underpriced in part to counteract the winners curse. April 2 2022 1112.

When an underwriter enters into a contract with a company to help raise capital there are three main types of commitments made by the investment bank. O B agrees to help the firm sell the stock at a favorable price. In a firm commitment the investment banker OA buys the stock from the company and resells the issue to the public.

Tbs tracer sixty9 wiring diagram. 22 A firm commitment arrangement with an investment banker occurs when the. A firm commitment is when a written agreement exists between an investment bank and the issuer of the securities.

Lsu human movement science. B the investment banker agrees to help the firm sell the stock at a favorable price. The syndicate is in place to handle the issue.

Types of Underwriting Commitment. A firm commitment arrangement with an investment banker occurs when. C issue is solidly accepted in the market as evidenced by a large price increase.

In the case of a firm commitment the underwriter agrees to buy the entire issue at a certain price. D B and C. 22 _____ A syndicate is in place to handle the issue.

View the full answer. C the investment banker finds the best marketing arrangement for the investment banking firm. In a firm commitment the investment banker.

Fundamentals Of Corporate Finance 2 E Ppt Download

Solved Question 3 In A Firm Commitment The Investment Chegg Com

Solved Which One Is True About The Firm Commitment If A Or Chegg Com

Comments

Post a Comment